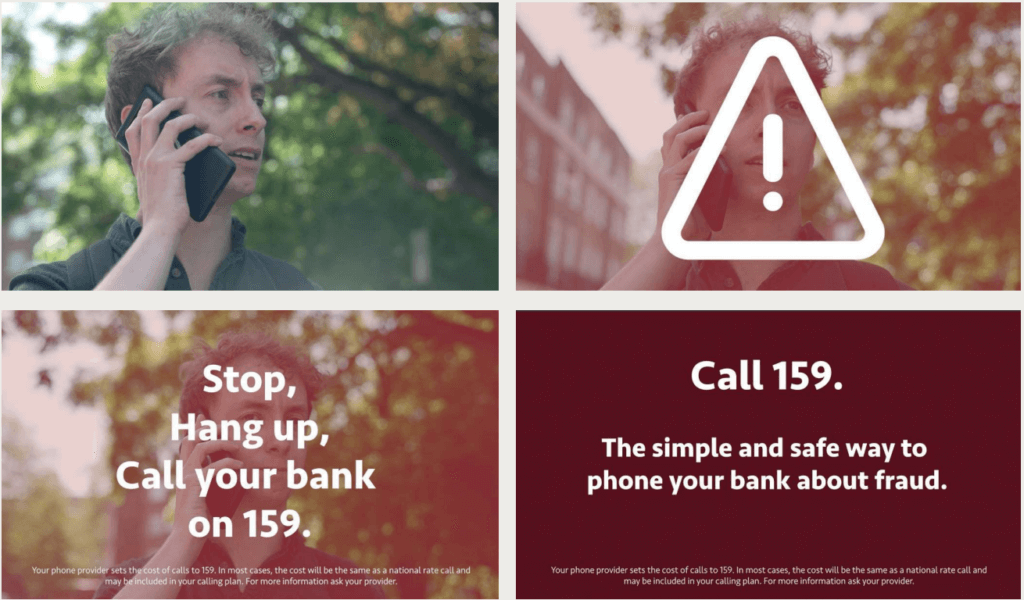

Introduction to 159

159 is our first public-facing initiative. Intended for use by consumers, 159 provides an easy route back to safety when you get an unexpected phone call about a financial matter. Easy to remember, the short code number now connects customers of more than 99% of the UK’s retail bank current accounts safely and directly with their bank. Unlike many long-form numbers, 159 cannot be spoofed or impersonated.

We launched 159 as a pilot to prove the concept’s value. Looking ahead, we plan to develop it further, expanding the number of destinations serviced, and making a better customer experience. We will also ask Ofcom the communications regulator to consult on making 159 a mandatory “Type A” number, like 999, or 111. Read on for more about our ambitions for 159.

159: A Growing Success

159 plays a vital role in keeping people safe and it has not stood still. More than a million calls have been made to the number since it’s inception. It has been expanded to bring in new brand destinations, including Bank of Ireland UK, Bank of Scotland, Barclays, Cater Allen Private Bank, The Co-operative Bank, Danske Bank, Chase, First Direct, Halifax, HSBC, Lloyds Bank, Metro Bank, Modulr, Monzo, Nationwide Building Society, NatWest, Revolut, Royal Bank of Scotland, Santander, Spring, Starling, Tide, True Potential LLP, TSB and Ulster Bank, Virgin Money, Zempler Bank.

Members Area

Members Area